|

|

Dear Customer,

As part of our effort to provide the highest possible value to you, we would like to ensure you are taking full advantage of the benefits that come along with choosing NxtWall as your preferred wall system. Currently, there are some incredible tax benefits available when using NxtWall's wall systems.

Section 179 can improve your bottom line in 2013. If you´ve been thinking about doing any reconfigurations or building new walls, then this is the year to do it. The Government is providing a generous tax deduction in 2013:

|

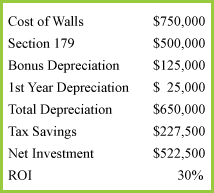

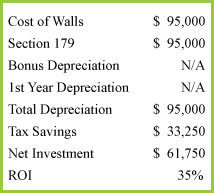

• Demountable Walls are considered by the IRS to be furniture, which allows for significant reduction in time for depreciation. NxtWall walls can be depreciated in 7 years, as opposed to standard construction wall's 39 year period.

• The American Taxpayer Relief Act of 2012 allows companies to take "bonus depreciation" by writing off 50% of the cost of their purchase of walls in the first year if installed in 2013.

|

|

|

• Section 179 allows companies to write of 100% of their demountable wall purchase in the first year, up to $500,000. If the cost of the walls purchased is greater than $500,000, bonus depreciation can be utilized after deducting the first $500,000.

The two pricing tables shown present possible examples of what your tax savings and net investment would be assuming a tax rate of 35%. |

|

|

|

Visit us online: www.nxtwall.com

Copyright 2013 NxtWall. All Rights Reserved.

|

|